Table Of Content

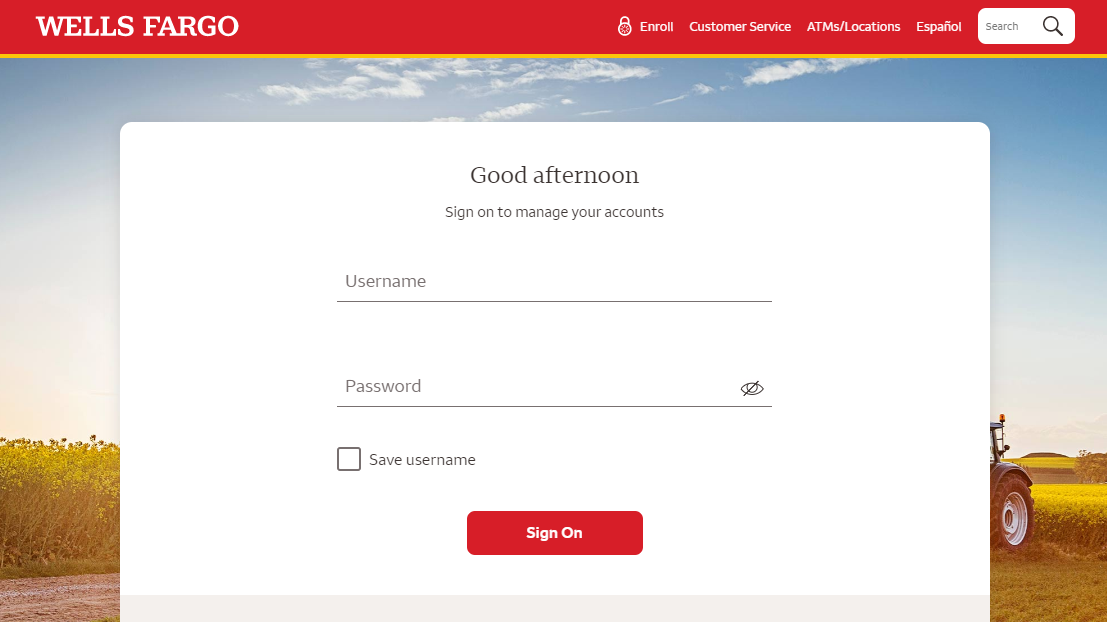

We recommend you make sure your image is ready to upload before you begin to give yourself more time to crop, resize, and place your image as well as review your overall design. The system allows 30 minutes for the customization process and will alert you when you have 5 minutes remaining to complete your session. If your Wells Fargo Online session times out before you click Submit and receive a confirmation, you will need to start the customization process again. For background images you must have pixel dimensions that are greater than or equal to 840x840.

Wells Fargo's New Virtual Assistant, Fargo, to Be Powered by Google Cloud AI - Wells Fargo Newsroom

Wells Fargo's New Virtual Assistant, Fargo, to Be Powered by Google Cloud AI.

Posted: Mon, 24 Oct 2022 07:00:00 GMT [source]

How long will a balance transfer request take to post to my Wells Fargo account?

Other factors, such as our proprietary website's rules and the likelihood of applicants' credit approval also impact how and where products appear on the site. Wells Fargo will review your customizations and image selection then send you an email within approximately 2 business days to let you know if your design is approved. Once approved, your new card should arrive in approximately 5-7 calendar days.

Is there an annual fee on the Wells Fargo Reflect Credit Card?

For new checking accounts visit open an account online or schedule an appointment to open an account in a branch. If you choose to upload your own image, please adhere to the image guidelines. Expect your new card to arrive in 5 to 7 calendar days after your image has been approved. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

Wells Fargo Autograph Card: A top pick for everyday travel - Bankrate.com

Wells Fargo Autograph Card: A top pick for everyday travel.

Posted: Thu, 14 Mar 2024 07:00:00 GMT [source]

Using an ATM with my card

To get a business credit card, you’ll need to supply both personal and business information and documentation. On the personal side, you must share your contact information as well as your Social Security number or ITIN. For the business side, you must provide your business's legal name, address, and contact details and employer identification number (EIN) if you have one.

Credit Card Help

Wells Fargo has provided this link for your convenience but does not control or endorse the website and is not responsible for the content, links, privacy policy, or security policy of the website. Department of Treasury's Office of Foreign Assets Control (OFAC). Wells Fargo Rewards offers you a wide variety of ways to earn, use, and share rewards — from Travel, to Gift Cards, to Merchandise, and more. If you choose to remove your customization or select a new customization, your original image will no longer be available and you will have to recreate your customization. Sometimes you can successfully alter your image files using a photo software application from your camera company or another photo-editing tool.

We provide you your daily ATM withdrawal and purchase limits when you receive your Card. You can confirm or manage your card's daily limits by signing on to Wells Fargo Online or the Wells Fargo Mobile® app, or calling the number on the back of your card. We may also notify you about changes to your debit card such as when your debit card has been added to a digital wallet or when your card is about to expire and you should confirm the shipping address for the new card.

Already have an account with Wells Fargo?

With our enhanced security technology, you no longer need to let us know when you plan to travel. Please make sure your contact information is up to date so we can let you know if we find any unusual activity. Sign on to Wells Fargo Online® to request a replacement card. Deferred interest plans are often advertised in retail stores as charging “no interest until” a certain date. After that date, however, the interest that has been accruing since the purchase date is charged to the account.

How do I customize my Wells Fargo credit card?

Neither the card nor the PIN provides the ability to transact online or at the Wells Fargo National Business Banking Center. A business deposit card can be used as part of customer authentication procedures to perform a deposit in a Wells Fargo branch. Business deposit cards can only be used at Wells Fargo ATMs. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. Balance transfers made within 120 days from account opening qualify for the introductory rate. If you recently customized one or more personal credit cards, there will be a waiting period before you can customize additional cards on your account.

However, we may receive compensation when you click on links to products from our partners. If metal isn't a necessity, you can consider the rest of the best Citi credit cards. Otherwise, there are plenty of other metal credit cards to check out from other issuers. If your card is already customized, your new replacement card will come with the same design that appeared on the card that was lost or stolen. Wells Fargo reserves the right to accept or reject any artwork, images or logos.

In addition, it is not any company’s responsibility to ensure all questions are answered. You’re headed to Biltrewards.com now, and although Wells Fargo has a relationship with Bilt, we do not operate their site and their security and privacy policy may be different. Our products and services may vary by location, and a ZIP Code helps us provide accurate information. If you choose not to enter a ZIP Code you’ll be redirected to our home page.

It allows businesses to make purchases, manage funds, and separate personal and business expenses. If your device is lost or stolen, we recommend remotely disabling the cards from your digital wallet. We also recommend notifying your mobile carrier and calling the Wells Fargo number on the back of your card promptly.

Please inform any merchants with whom you have scheduled payments that your card's expiration date has changed to ensure that your payments continue without interruption. Following a growing trend among credit cards, the Wells Fargo Reflect® Card offers cell phone protection. When you use your card to pay for your monthly cell phone bill, you can get up to $600 in coverage — up to two times per year — against theft and damage to your phone. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank.

All you have to do is log into your account and click on Services, followed by Manage Card & Devices and then New Card Design. Expect to wait three to seven days to get your shiny new card in the mail. We are committed to being fully transparent with our readers. Opinions expressed here are the author’s and/or WalletHub editors'. WalletHub editorial content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any company.

Please refer to Intuit's terms of use and privacy policy, which are located on Intuit's website and are administered by Intuit. The Wells Fargo Card Design Studio’s image library includes categories like animals, nature, sports and hobbies, business and industry, and more. If you’re using your own image, make sure it meets the Design Studio’s guidelines. Images containing copyrighted material, profanity, or obscene gestures will be rejected. Wells Fargo may also reject images of poor quality as well as images larger than ten megabytes (10 MB). You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo does not allow applicants to choose a custom design. We started in a couple of key high-volume markets and now we're rolling out nationally to our entire footprint. Instead of having a separate offline process to open a mobile app, open a checking account, or send a wire, you can walk in and say, "I want to open a checking account." Okay. Download the mobile app, scan this QR code, and the banker working with you can pre-populate stuff and within five to seven minutes you're up and running. While you're there, we can teach you how to set up Zelle so you can make person-to-person payments.